WhatsApp)

WhatsApp)

recoverable amount of its equipment and mining interests. c) ... Depreciation is allocated based on assumed asset lives. Should the asset life or depreciation rates ...

Accelerated depreciation; ... Effective life of intangible depreciating assets that are mining, ... Guide to depreciating assets 2014

The useful life of an asset is necessary element for calculating depreciation for tax as well as ... Replace wornout equipment. ... of useful lives of the ...

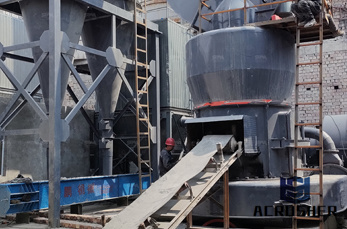

depreciation mining equipment. WearResistant Rubber. Product Introduction Domestic unique rubber sheet used in wet condition Working Pressure Pressure ≤ ...

Fixed Asset Depreciation. If you have fixed assets they need to be depreciated. Depreciation of assets are done through regular writeoffs for wear and tear.

Table List of depreciation rates under the new asset code classification — Other machinery and equipment (continued), oil and gas exploration, mining ...

Metal Working and Transportation, Mining, Motor Vehicles and Parts, Paper Finishing, Petroleum ... 2015 DEPRECIATION SCHEDULES EQUIPMENT CLASSIFICATIONS .

Depreciation is usually a forgotten area that can impact on a company''s bottom line as assets age, capital replacement is not planned or instigated.

The MACRS Asset Life table is derived from Revenue Procedure 8756 19872 CB 674. The table specifies asset lives for property subject to depreciation under the ...

Chapter 11 Depreciation, Impairments, and Depletion ... Chapter 11 Depreciation, Impairments, and Depletion ... Depreciation—Equipment to reduce the carrying .

depreciation rate in mining industry [ 6959 Ratings ] The Gulin product line, consisting ... Mining Equipment Depreciation Lives myweeklycheck.

Whither Tax Depreciation? 515 lives were very short. (This favoritism can be reduced, but not eliminated, by basis adjustments, which allow depreciation

Manufacturing Equipment Depreciation Calculation. Posted on October 29, 2015 by dGuru. ... Below are the associated class lives and recovery periods:

Mining; Mining Equipment ; Coal; Iron Ore; Gold Silver; Uranium; Utilities; Water; ... The depreciation lives of these cables are derived from analysis of demand, ...

Reducing Depreciation Allowances to Finance a Lower Corporate Tax Rate 1041 Table 1 Eff ective Tax Rates by Asset Type, No Change in Statutory Tax Rate

Mining Toolbox Life Cycle Costing Application. Including Haul Trucks, Hydraulic Shovels, Electric Shovels, Bulldozers, Graders, Wheel Loaders and Wheel Dozers

depreciation rates for mining equipment; Gravity Separation Equipment. Detailed information Service Online. Grinding Mill. ... Depreciation and Depletion – CEMRWEB.

mining equipment equipment life useful life data [ 9541 Ratings ] The Gulin product line, consisting ... Mining Equipment Depreciation Lives. Article: ...

Manual Transmittal July 26, 2016. Purpose (1) This transmits revised IRM, Financial Accounting, Property and Equipment Accounting.

Financial Accounting Manual for ... Maximum useful lives for furniture and equipment asset groupings ... and begin depreciation when the equipment is placed into ...

Useful Life Of Mining Equipment In Za. ... Depreciation on equipment utilized in the development of assets, ... Estimated useful lives of Major Asset Categories.

Depreciation of property, plant and equipment . The carrying amounts of property, plant and equipment (including initial and any subsequent capital expenditure) are ...

Depreciation Regulations Revisions to Depreciation Periods—Part 4 6 Stevedoring and warehousing equipment and wholesale and retail loading

mining equipment useful life . Depreciation and Depletion ... Useful Lives and Depreciation... macrs depreciation schedule Docstoc – We Make Every Small ...

WhatsApp)

WhatsApp)